All things considered, it has only been about 3 months since Trump took office, I feel like there is absolutely no way that this was just a single craze and from here things will even out.

I feel like until 2028 (or maybe 2026?) S&P 500 is going to look like a roller coaster.

What do you think?

Shit winds are a comin

It’s not the tip of the shitberg, it’s the edge of the shittacane, Randy.

Almost certain that Trumspki will do something stupid soon and then more stupid shit after that. The S&P will be look like a wild roller coaster.

We’re hardly even three months in… We’ve got a loooong way to go before even the midterms.

Wake up, people.

Taiwan makes 50% of the world’s semiconductor ‘chips’. They just announced a US$100 billion investment to build a fab plant in the US, to manufacture chips in the US. A few things about that.

No American company has anywhere close to $100 billion to invest in anything, The American corporations used their profits to buy back their stock not to invest n production. What cash they had left over, they invested in stocks and bonds, which they have to try and sell before they can use the money. American corporations are. essentially, cash liquidity poor despite their huge profits. They do not have the liquidity to build anything. Musk may be the world’s richest man on paper, but a few Chinese financiers have much greater liquidity wealth than he does, and they are actually able to BUILD things. It is the difference between financialized wealth and actual money.

South Asia has enough investment money to build more kilometers (miles, if you are American) of high speed rail every year for the last several years than the US has TOTAL, and this money is just a drop in the bucket to them. There just is not enough liquidity in American corporations to build anywhere close to what China can do. American corporations squandered their wealth in the pursuit of maximizing profit payouts to shareholders, and the shareholders just used this capital to buy the same shares at higher and higher prices Not a penny of that money went into building new plant, it just went to increasing the price of existing shares.

Essentially, America is becoming a branch plant operation of Chinese corporations with profits going back to South Asian investors, and Americans get stupidly low wages. America is rapidly becoming the low-wage country of the world. The lower the stock market goes, the cheaper it is for South Asian money to buy up control of American corporations. When GM went bankrupt, China bought the restructured shares. When Ford almost went bankrupt, China bought the non-American Ford subsidiaries to save Ford, but essentially gained complete control of Ford. All profits from Ford auto sales go back to China. Haier now owns General Electric Appliance Division, and is now making what are essentially Haier appliances in America, using cheap slave-labor-wage Americans to build them cheaper than they can in China. All the profits, however, go back to China.

The Law of Unintended Consequences. The Trump misguided policies are just accelerating the sell-off of America. Trump wants foreign corporations to build their product in America, using cheap American labor, ignoring completely that the profits all flow out of America and the foreign investors now control American production.

Like Trump said, it is a good time to get rich. Like Trump dd NOT say, it is the South Asians that are getting rich. China owns most of the American treasury bills, now China will soon own most of the American production plant.

Good, China can lead, because the West fucking sucks at it. - a westerner.

I wholeheartedly agree. The West has gotten what it deserves. America squandered everything, and is now left with nothing but scraps.

Sell America’s future to the 1%, destroy the middle class, attack voting, attack education, make health issues a financial death sentence.

Omg why don’t our citizens love us. 😯

Almost. it is 'selling America’s future to the top 20%. It would take at least 10% to actually form a viable economy. The Roman Empire and the British Aristocracy in antiquity realized that. So has Putin, North Korea., and Saudi Arabia. The system needs a critical mass to ensure survivability and continuity

The plan is to declare martial law on the 20th.

So we’ll see if that effects the stocks.

I’m more concerned with the bond sell-off, that’s a very bad sign.

Can you explain a little further? I don’t know what you are talking about

The original reply was great, I just want to make it dead simple: if bonds continue to be sold off in these numbers, it indicates investors no longer believe in a future where the US dollar is the international reserve currency. This is very bad if you’re an American.

If you have 20 minutes to spare this video really helped clear it up for me.

It might seem unrelated at first, but bonds will be discussed approx. 5 minutes in, and the preceding parts helps lay the groundwork.

I’d later come to understand this is called Modern monetary theory.

My knowledge is very superficial, but usually government bonds are a very safe investment. It’s basically how countries can even go into debt. In times of market uncertainty, you would expect that investors who sell off stocks put their money into bonds. However, investors are also selling US bonds, which means confidence in the US is waining. The US dollar is on track to losing it’s place as the world’s reserve currency.

This is all very bad for the US, since it also means they have to increase interests in bonds so people keep buying, which leads to more taxes since the interests on the bonds is the interest the US has to pay on their debt.

Please correct me if I am wrong

The thing about the stock market, no one freaking knows. The market has taken horrible dives before and has recovered. I also don’t believe the USA is the only country that should be worried if something does go down. The fact that some experts are saying things could be different may be worrying, but ultimately no one knows. All we can do is try our best to prepare for the worst. I wouldn’t be surprised if the protests continue to grow over the summer months in the USA.

I completely agree with you. The real shit show hasn’t even started. The waves from the tsunami will take a while to hit.

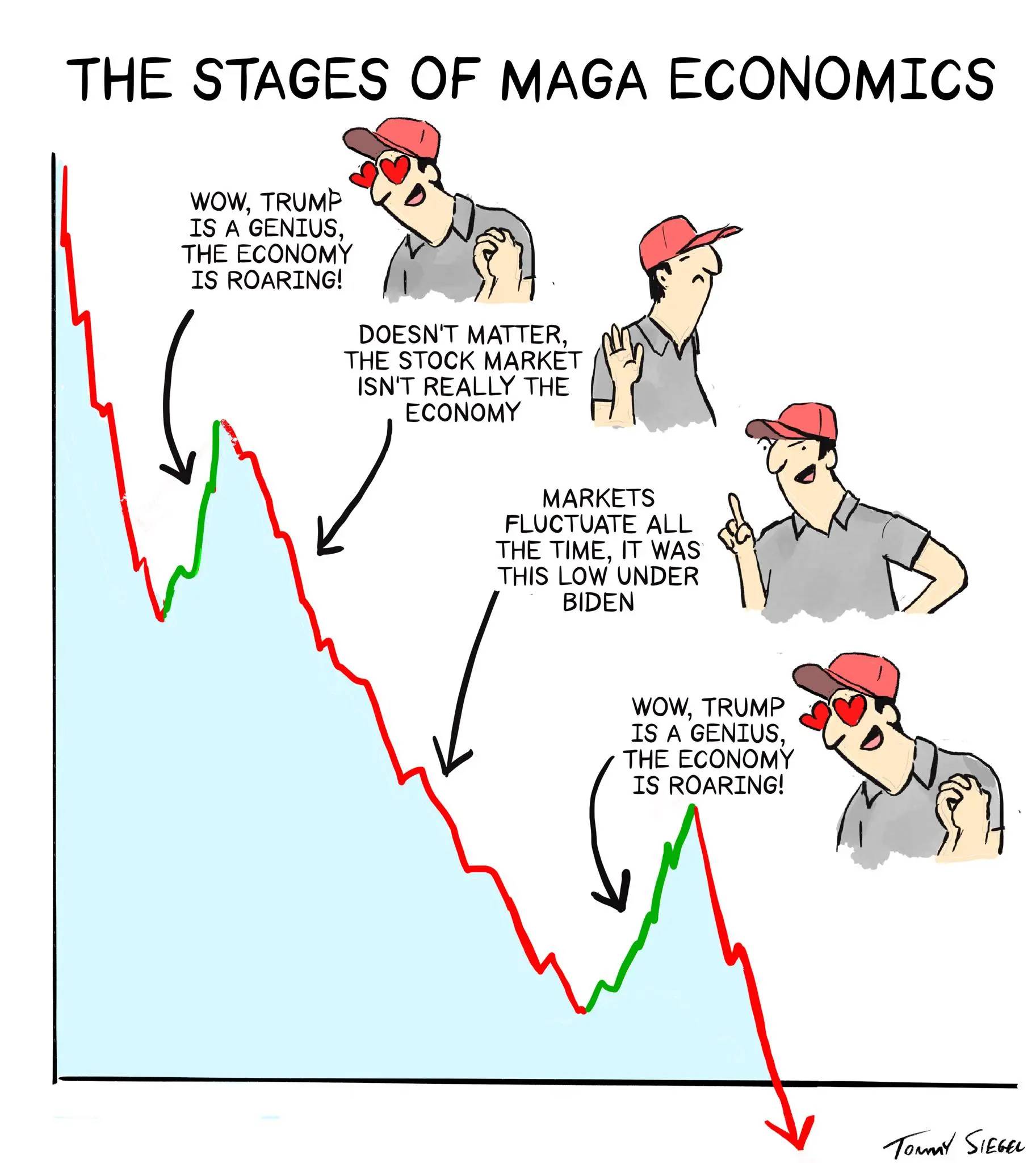

Some of the greatest daily gains in the stock market are during overall crashes.

Increased volatility is generally a bad sign for an economy’s health.

This. Uncertainty destroys value. No-one can deny that Trump generates uncertainty.

i mean he postponed it for 80/90 days or something so i guess this exact thing is going to repeat itself, because to me that looks like it would be the most profitable for trump

I have a very hard time believing that the rest of the world will trust the US for a very long time, if ever, so I can’t imagine our financial situation is going to improve for anyone except maybe the ultra wealthy (as usual). I haven’t even looked at my retirement because it’s not like there’s much I can do besides stress about it.

Well, there are a lot of factors here that I expect would be factors, both increasing and decreasing what he does over the course of the term.

-

Right now, the Republican Party has a trifecta, and thus even GOP legislators who are not very happy with aspects of Trump are going to be very loathe to have fights with Trump, because this trifecta lets it pass lots of legislation that the Democrats would otherwise block; getting in a fight with Trump could mess that up. The incentives there will decline over the course of the term, since they’ll have increasingly gotten through the legislation that they want; Trump being happy becomes less-important.

-

A major reason for Trump doing well in the presidential election was public unhappiness with inflation under Biden. Major global tariffs would also tend to drive up prices, and Republican legislators are not going to be happy about that, even aside from recession issues. I’ve seen both Republican and Democratic legislators commenting on the fact that this would probably be politically-damaging to the Republican Party; that’s probably a source of pushback.

-

One threat that Trump has frequently made is to endorse a competitor to a Republican legislator who doesn’t get along with them. This meaning something is contingent on Trump’s endorsement bearing weight, which requires sufficiently-high public approval of Trump in the district. If Trump takes unpopular actions, that endorsement matters less.

-

Just because you don’t see a lot of Republican legislators arguing with Trump doesn’t mean that it’s not happening, quietly. The Republican Party has good political reasons to keep disagreements behind closed doors. Mike Johnson has made a number of statements about how he has had an extremely difficult job dealing with people getting along; he’s an interface between the House and the White House.

-

What happens at midterms is going to be, I think, consequential. The Republican Party has good political reasons not to jam sticks in Trump’s wheels as long as he at least keeps things within bounds, and certainly not to do so publicly. The Democratic Party has good political reasons to constantly visibly jam sticks in Trump’s wheels. If the Democrats take the House in 2026, they have a lot of room to do things like initiate inquiries and demand information that they just don’t have right now.

-

Late in the term, Trump is going to care less about popularity; that’s why Presidents tend to do politically-controversial pardons right at the end. So he might be willing to take some particularly controversial actions at the end.

-

Late in the term, Trump is going to have a harder time making changes that last, because it’ll be easier to just reverse them or slow them from having effect. Trump laying off people at the beginning of his term is hard to reverse; said laid-off people probably aren’t going to just stick around for four years hoping to get their job back. If he does so three months before leaving office and his successor doesn’t like that, they’re probably largely just going to be rehired. So he has a hard time making lasting actions at the end.

-

Trump’s tariff policy is based on a very weak legal structure. Normally Congress sets tariff policy, not the President, but Congress passed a law some decades back that permits the President to impose tariffs in emergencies. Trump proceeded to declare that fentanyl was an emergency and then started declaring that he’d throw up tariffs left and right. Whether or not the tariffs on even Mexico have any real basis in addressing fentanyl is questionable. Tariffs on Canada on fentanyl grounds are extremely questionable, as very little fentanyl enters the US from Canada, and tariffs on most of the world are even more decoupled from that. There’s a pretty strong argument that he’s got no legal authority there, and the only reason that he’s able to do it is because Congress hasn’t taken action against it. Congress can, if it wants, simply terminate the emergency he declared, at which point his power also evaporates (and has some more-forceful options as well, like taking issue at the Supreme Court with whether-or-not his use of that power is actually in line with even the declared emergency, or, if a supermajority in both the House and Senate want, simply entirely terminating the Presidential authority to impose tariffs at all, and then override a Presidential veto). The Senate already had a bipartisan bill pass about terminating the emergency over the Canada tariffs; last I looked, it was expected to fail in the House — that is, this is a public statement rather than aiming to force an end — but it’s a shot across the bow where the Senate is taking issue with some of his tariff policy. Trump’s ability to take action on tariffs is deeply dependent upon Congress choosing not to involve itself. I’m skeptical that Congress will accept global tariffs, even if Trump wants them, and Congress has pretty straightforward routes to avoid them. My guess is that Congress has probably communicated some things about what it’ll actually accept to Trump.

-

Speaking even more-broadly, if it actually comes to some kind of real arm wrestling…the President has very extensive direct control over a large organization with millions of people, the Executive Branch. That’s what makes him powerful. But the reason that he has virtually all of that power is because Congress gave it to him in the past (“we authorize the President to have this much money to create a department and then tell it what to do”). Congress can take it away, and with a supermajority in each house, override Trump’s veto of such legislation. Even in areas where the Constitution very explicitly gives a power to the President, like commanding the military, Congress has written legislation to limit ways in which he can act, like the War Powers Resolution:

https://en.wikipedia.org/wiki/War_Powers_Resolution

The War Powers Resolution requires the president to notify Congress within 48 hours of committing armed forces to military action and forbids armed forces from remaining for more than 60 days, with a further 30-day withdrawal period, without congressional authorization for use of military force (AUMF) or a declaration of war by the United States. The resolution was passed by two-thirds each of the House and Senate, overriding the veto of President Richard Nixon.

During Trump’s first term, Congress passed legislation that disallowed the President from removing sanctions on Russia without going back to Congress and getting an okay.

Hypothetically, I imagine that Congress could probably impose a lot of restrictions on Trump, or even shift direct authority over Executive Branch departments to itself; it has, in the past, created a small amount of the bureaucracy that reports directly to Congress.

My guess is that the Republican Party does not want to see any kind of an arm-wrestling scenario like that, though, as it’d be really politically bad. It’d instead warn behind closed doors that it might be willing to do that, and ward off things reaching that point. Hell, Democratic Party doesn’t want things reaching that kind of point either. But my point is, Trump’s got real constraints on what he can do. He cannot just go ignore Congress.

That’s mostly talking about constraints on Trump’s power. So, there’s a broader question here: will Trump continue to say outrageous things? My guess is almost certainly yes. He’s shown no interest in stopping doing so for either of his terms, and kept doing so right through his first term, so I doubt that that’s going to go anywhere.

This was very interesting, but I feel like your arguments as to why things won’t be as crazy is mostly based on congress stopping him, but why do you think they will?

Until 2026 is there any real reason to believe that they will? What did they do up until now? This is one of the biggest stock crashes in US history and it feels like they rolled with it and made a profit buying low and selling high

I think that Congress most likely has involved itself.

No it hasn’t! It didn’t do anything like pass a law to take away powers!

Congress’s first step is not going to be to take any of the sorts of most-extreme moves I listed above. That’d be far down the list of actions to take. What it’s going to do is to go talk to Trump, not in public, and tell him that this is not something that they’re going to go along with. My guess, as I wrote above, is that that has most-likely happened.

Several Republican legislators — Ted Cruz, for one — have said that a recession would produce a bloodbath for Republicans in the midterms. This is going to be them expressing publicly that this isn’t okay with them. Peter Navarro can say that he’s fine with a recession; that doesn’t mean that Congress would be.

They’ve also had the Senate pass a resolution on terminating the public emergency upon which his tariff power rests. The House wasn’t expected to also pass it, and Trump would probably veto it, requiring it reaching a veto-proof majority backing it if Trump chose to veto it. But it’s Congress publicly saying that this isn’t on.

Congress is not going to take the kind of most-extreme actions that I listed because Trump caused the stock market to take a dip.

Interesting, I understand your argument but I feel that it has a bit of the classic “too reasonable to be true” as in, I think you are assuming that the house would act reasonably. With everything that has happened, and the public statements of some of these people, I think a lot of them are very very unreasonable.

but why do you think they will?

There is one good historical indicator here. Clinton, Dubya, Obama, Biden, and Trump all entered their presidencies with control of Congress and lost it at the mid-terms. That’s just too strong a pattern to assume it won’t repeat.

The problem here is that the supposed ‘opposition’ is the Democratic Party, who themselves rule as conservatives and, in deed if not in word, support what Trump is doing.

-

What climb? Its still down 8.61% since he took office. Crazy to celebrate losing almost 9%.

By contrast Biden’s second to last year was UP 24.23%. His last year was up yet another 23.31%.

To put dollars on this:

- If under Biden you’d put $100,000 into the S&P500 on Jan 2023 on Dec 31 2023 you’d have $124,230.

- If still under Biden you left your $124,230 in the S&P500 on Dec 31 2024 you’d have $153,188.01.

- Under trump if you’d put $100,000 into the S&P500 on Jan 2025 by today Apr 13th 2023 you’d have $91,390

I see no cause for celebration here.

I agree, yet so many are thinking thibgs are okay now, wild

And the bond market is in freefall… That’s not good, worse than the sp500.